- The lowest APR

- 1.88%

- Total Amount Payable

- HK$205,760

- Total Interest Payable

- HK$5,760

- Monthly Payment

- HK$8,573

July Exclusive - Total Rewards up to HK$35,998! ⭐️

From now until 31 July, customers who successfully applied for WeLend Personal Loan / WeLend Civil Servant & Professional Loan via MoneySmart and submitted all the required documents can enjoy HK$1,000 Apple Store Gift Card🍎 (fulfilled by WeLend) - regardless of approval!

Successfully apply and drawdown the loan with a designated amount, can get MoneySmart Exclusive RO Water Server / Cordless Vacuum Cleaner; as well as Cash Rebate up to 🤑HK$32,000 from WeLend! Total rewards up to HK$35,998! 🎁

- The Lowest APR

- 1.18%

- Total Amount Payable

- HK$202,400

- Total Interest Payable

- HK$2,400

- Monthly Payment

- HK$8,433

- APR as low as*

- 1.15%

- Total Amount Payable

- HK$202,496

- Total Interest Payable

- HK$2,496

- Monthly Payment

- HK$8,437

【Use promo code「MS2700」**🏆 Total rewards up to HK$3,500】**

From 15 July until 31 July 2025, apply for X Wallet X Cash.AI via MoneySmart, and enter the promo code "MS2700", you can earn:

1. HK$800 Apple Store Gift Card / PARKnSHOP supermarket voucher / HKTVmall e-Voucher regardless of approval (fulfilled by MoneySmart)

2. HK$2,700 cash rebate* upon successfully drawing down HK$20,000 or above and meeting specified conditions (fulfilled by X Wallet)

- APR as low as*

- 1.98%

- Total Amount Payable

- HK$204,800

- Total Interest Payable

- HK$4,800

- Monthly Payment

- HK$8,533

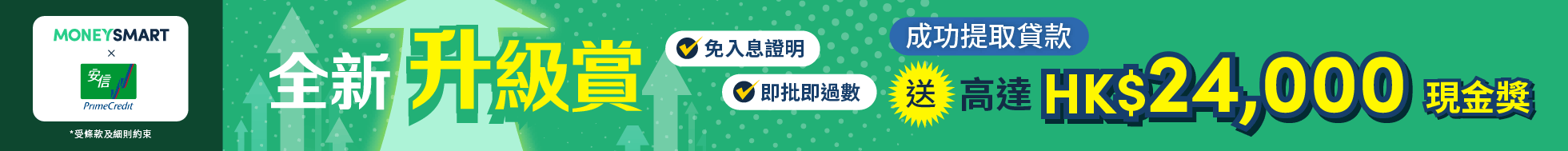

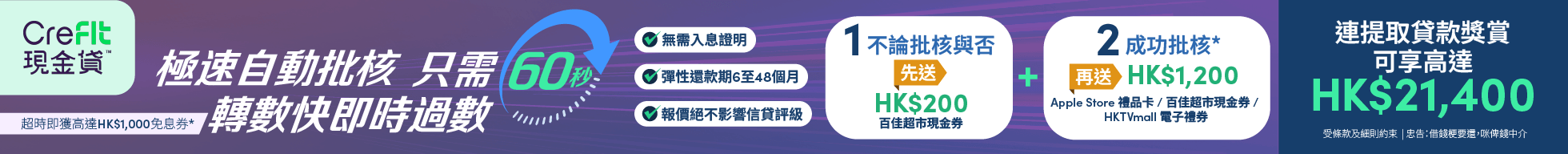

【MoneySmart Exclusive - Get up to HK$21,400 Rewards now!】

From 9th June until 30th December 2025, qualified new customer register and drawdown CreFIT Cash Loan with certain amount, with repayment period 12 months or more in order to enjoy up to HK$20,000 cashback.🎉

⠀⠀

From now until 31 July 2025, eligible new customer applying via MoneySmart can also receive up to HK$1,400 cash voucher (For details, please refer to MoneySmart's terms) ! Total rewards up to HK$21,400💰

⠀⠀

Incognito mode quotation with no impact on credit rating#, No income proof required, Cash Loan Approval Pledge^ Approval result in 60s. Get a HK$1,000 Interest Waiver Coupon if approval time overruns. Open an account and apply for a loan using the exclusive link and referral code!

- APR*

- 1.1%

- Total Amount Payable

- HK$202,304

- Total Interest Payable

- HK$2,304

- Monthly Payment

- HK$8,429

From 1 July 2025 to 31 July 2025, successfully apply for UA i-Money Express Online Personal Loan via MoneySmart, you can enjoy:

1️⃣ HK$1,000 exclusive cash (automatically converted by 10,000 SmartPoints) and will directly deposit into your FPS account for successful applications - regardless of approval!

2️⃣ Drawdown to enjoy up to HK$18,000 cash rewards^!

- APR*

- 1.12%

- Total Amount Payable

- HK$202,400

- Total Interest Payable

- HK$2,400

- Monthly Payment

- HK$8,433

【MoneySmart Exclusive】Drawdown of HK$10,000 or above to get rewards worth HK$2,100 (HK$1,600 cash + HK$500 supermarket voucher▲)!

⠀⠀

During promotional period, successfully apply for Promise Easy Loan/Promise No-doc Loan/Promise Debt Consolidation Loan via MoneySmart, you can enjoy:

⠀⠀

1️⃣ New Customers who have completed a drawdown of HK$10,000 or above, are entitled to enjoy HK$1,600 cash rebate (automatically converted by 16,000 SmartPoints and will directly deposit into your FPS account)

⠀⠀

2️⃣ Rookie loan applicants who have applied loan with promo code “SMART” and successfully drawn down the loan, are entitled to HK$500 supermarket voucher. No Supporting Documents Required#. Online Instant Approval⦿.

⠀⠀

Earn rewards worth up to HK$2,100 in total!

- APR*

- 4.49%

- Total Amount Payable

- HK$209,600

- Total Interest Payable

- HK$9,600

- Monthly Payment

- HK$8,733

【MoneySmart Exclusive】Drawdown of HK$10,000 or above to get rewards worth HK$2,100 (HK$1,600 cash + HK$500 supermarket voucher▲)!

⠀⠀

During promotional period, successfully apply for Promise Easy Loan/Promise No-doc Loan/Promise Debt Consolidation Loan via MoneySmart, you can enjoy:

⠀⠀

1️⃣ New Customers who have completed a drawdown of HK$10,000 or above, are entitled to enjoy HK$1,600 cash rebate (automatically converted by 16,000 SmartPoints and will directly deposit into your FPS account)

⠀⠀

2️⃣ Rookie loan applicants who have applied loan with promo code “SMART” and successfully drawn down the loan, are entitled to HK$500 supermarket voucher. No Supporting Documents Required#. Online Instant Approval⦿.

⠀⠀

Earn rewards worth up to HK$2,100 in total!

- The Lowest APR

- 1.18%

- Total Amount Payable

- HK$202,400

- Total Interest Payable

- HK$2,400

- Monthly Payment

- HK$8,433

- The Lowest APR

- 1.18%

- Total Amount Payable

- HK$202,400

- Total Interest Payable

- HK$2,400

- Monthly Payment

- HK$8,433

- APR*

- 1.38%

- Total Amount Payable

- HK$202,880

- Total Interest Payable

- HK$2,880

- Monthly Payment

- HK$8,453

From 1 July 2025 to 31 July 2025, successfully apply for UA Civil Servants and Professionals Express Loan via MoneySmart, you can enjoy:

1️⃣ HK$1,000 exclusive cash (automatically converted by 10,000 SmartPoints) and will directly deposit into your FPS account for successful applications - regardless of approval!

2️⃣ Drawdown to enjoy up to HK$18,000 cash rewards^!

- The lowest APR

- 1.88%

- Total Amount Payable

- HK$205,760

- Total Interest Payable

- HK$5,760

- Monthly Payment

- HK$8,573

July Exclusive - Total Rewards up to HK$35,998! ⭐️

From now until 31 July, customers who successfully applied for WeLend Personal Loan / WeLend Civil Servant & Professional Loan via MoneySmart and submitted all the required documents can enjoy HK$1,000 Apple Store Gift Card🍎 (fulfilled by WeLend) - regardless of approval!

Successfully apply and drawdown the loan with a designated amount, can get MoneySmart Exclusive RO Water Server / Cordless Vacuum Cleaner; as well as Cash Rebate up to 🤑HK$32,000 from WeLend! Total rewards up to HK$35,998! 🎁

- APR*

- 1.98%

- Total Amount Payable

- HK$204,800

- Total Interest Payable

- HK$4,800

- Monthly Payment

- HK$8,533

- APR as low as*

- 1.38%

- Total Amount Payable

- HK$204,800

- Total Interest Payable

- HK$4,800

- Monthly Payment

- HK$8,533

【MoneySmart Exclusive - Get up to HK$21,400 Rewards now!】

From 9th June until 30th December 2025, qualified new customer register and drawdown CreFIT Cash Loan with certain amount, with repayment period 12 months or more in order to enjoy up to HK$20,000 cashback.🎉

⠀⠀

From now until 31 July 2025, eligible new customer applying via MoneySmart can also receive up to HK$1,400 cash voucher (For details, please refer to MoneySmart's terms) ! Total rewards up to HK$21,400💰

⠀⠀

Incognito mode quotation with no impact on credit rating#, No income proof required, Cash Loan Approval Pledge^ Approval result in 60s. Get a HK$1,000 Interest Waiver Coupon if approval time overruns. Open an account and apply for a loan using the exclusive link and referral code!

- The lowest APR

- 1.88%

- Total Amount Payable

- HK$205,760

- Total Interest Payable

- HK$5,760

- Monthly Payment

- HK$8,573

From 1 July 2025 - 31 July 2025, apply for WeLend designated loan via MoneySmart, successfully drawdown a designated loan amount, can earn up to 💰 HK$32,000 Rewards!a

- The Lowest APR

- 1.88%

- Total Amount Payable

- HK$205,760

- Total Interest Payable

- HK$5,760

- Monthly Payment

- HK$8,573

- The lowest APR*

- 1.88%

- Total Amount Payable

- HK$205,760

- Total interest payable

- HK$5,760

- Monthly Payment

- HK$8,573

From 1 July 2025 - 31 July 2025, apply for WeLend designated loan via MoneySmart, successfully drawdown a designated loan amount, can earn up to 💰 HK$32,000 Rewards!a

- The Lowest APR

- 1.18%

- Total Amount Payable

- HK$202,400

- Total Interest Payable

- HK$2,400

- Monthly Payment

- HK$8,433

- APR*

- 8.0%

- Total Amount Payable

- HK$232,160

- Total Interest Payable

- HK$32,160

- Monthly Payment

- HK$9,673

- APR*

- 4.63%

- Total Amount Payable

- HK$209,600

- Total Interest Payable

- HK$9,600

- Monthly Payment

- HK$8,733

- APR*

- 4.63%

- Total Amount Payable

- HK$209,600

- Total Interest Payable

- HK$9,600

- Monthly Payment

- HK$8,733

.png)

.png)